14 PF Withdrawal for construction purchase of houseland Paragraph 68B. Now to withdraw your funds online you need to select the PF Advance Form 31 option.

Difference Between Epf And Ppf Income Investing Investing Basic

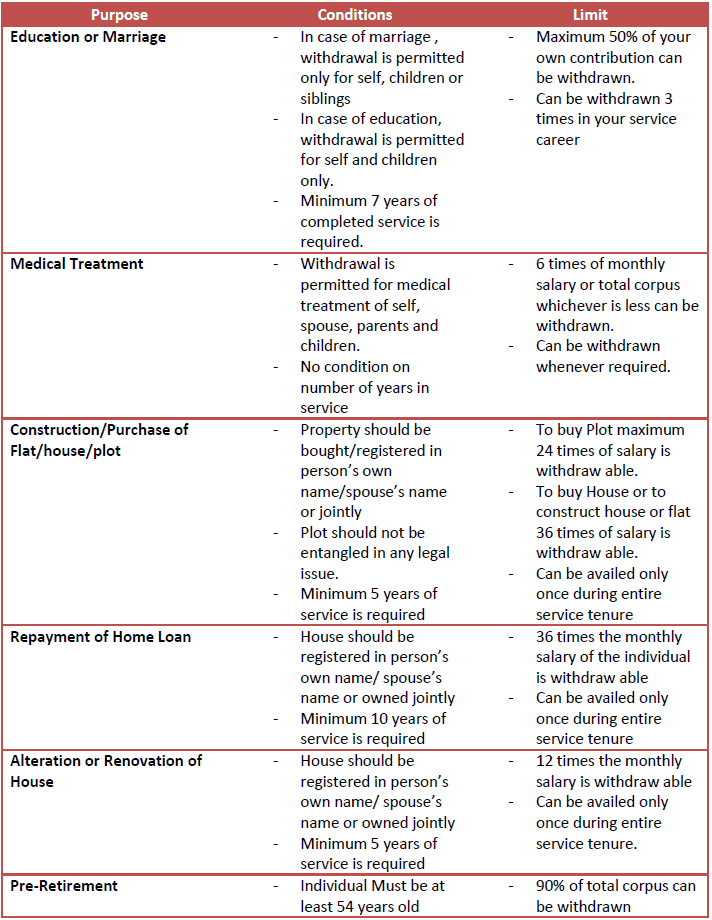

Partial early withdrawal from EPF is now permitted for a childs marriage higher education and making a down payment for a house subject to conditions.

. What is the Withdrawal Limit of Do You Withdraw from EPF for Education. So if at all there is an emergency and you need the funds here is all you need to. We will cover the following topics.

The provident fund regulator has mentioned in its website that non. An employee can also withdraw the EPF amount for his sons or daughters higher education needs. This is a unique loan as you dont need to return the same.

A PF or EPF account holder can also withdraw the EPF balance to pay for urgent medical treatments for certain diseases. Membiayai Pendidikan Tinggi Anda. An employee can withdraw up to 90 of the PF amount after attaining the age of 54 or one year before the age of superannuation whichever is later.

Members can apply by completing the KWSP 9H AHL form and submit together with supporting documents. This means the funds can be withdrawn for any course at a college or university for graduation and above. Withdrawal under sl no e above.

11 PF Withdrawal for Marriage Paragraph 68K. Withdrawal from the fund for repayment of loans in special cases. It means if youre getting your daughter admitted to a college and you need money for her college fees.

Yet its applicable in the case of higher education only. It can be your sibling or brothersister. Ahli boleh memilih untuk mengeluarkan simpanan daripada Akaun 2 bagi membantu membiayai pendidikan sendiri pasangan suamiisteri anak-anak danatau ibu bapa di.

Medical Emergency 2Childrens Higher Education 3Marriage SelfSiblingsChildren 4. EPF Withdrawal for Education Including PTPTN. An employee can withdraw up to 50 of his PF amount from his EPF account.

Pendidikan yang berkualiti merupakan kunci kepada kestabilan kerjaya sekali gus membina kehidupan yang lebih selesa untuk ahli dan keluarga ahli. The Employees Provident Fund. Withdrawal from Account 2 to fund own or childrens education.

Tertiary education is exceptionally expensive these days and while PTPTN has done a good job of assisting those who need help with paying for tuition fees it may be difficult to immediately repay your study loan in the years after you start working. KUALA LUMPUR 22 April 2016. It is treated more like a withdrawal from the corpus that gets accumulated month-on-month and year-on-year.

Some money from your EPF can be withdrawn for educational purposes. The form can. With that in mind the EPF allows you to.

Get Free Credit Report with Complete Analysis of Credit Score Check Now. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Step 1- Sign in to the UAN Member Portal with your UAN and Password.

Contents hide 1 EPF Partial Withdrawal Rules 2020. Another condition that needs to fulfilled before applying for withdrawal is that you have to complete seven years as EPFO member. Thus youre eligible to withdraw.

Before applying for withdrawal under this scheme EPF members are required to check the balance in Account II and obtain a letter from EPF that specifies the amount that can be withdrawn. This facility is allowed for both self-usage or to pay for treatment of immediate family members. Settlement of withdrawal under old Family Pension Fund.

12 PF Withdrawal for Education Paragraph 68K. Your son daughter sibling or yourself can make the withdrawal for their education. Members are also allowed to withdraw the entire amount if they remain unemployed for more than two months.

You can make up to 3 withdrawals from these criteria. A For refund of outstanding principal and interest of a loan for purposes under Para. This form is usually submitted with F-1920 for the following schemes.

Quality education is the key to a stable career that will result in a comfortable life for you and your family. So the salary you receive on hand comes after the deduction of PF. Are encouraged to use the e-Pengeluaran facility as it is a more efficient alternative to submitting their housing or education withdrawal applications at EPF branches.

You can choose to withdraw your savings from Account 2 to help finance your own children spouse andor parents education at approved institutions locally or abroad. You can even take a loan against your employees provident fund EPF for the education of your kids. Partial PF Withdrawal Rules for.

Form 10C is used for making claims of PF withdrawals. EPF Withdrawal Rules - Partial and Full in 20211. From the first roll-out in 2013 until April 2016 a total of 64297 applications for various types of withdrawals.

90 of the EPF balance can be withdrawn after the age of 54 years. Depending on the course you take the need for a post-malnutrition program will be necessary. 6 hours agoGoing by the EPFO rules a subscriber can withdraw up to 75 per cent of the outstanding EPF balance or three months basic pay plus Dearness Allowance DA whichever is lower.

After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment. 13 PF Withdrawal for Medical Treatment Paragraph 68J. 12 months basic wages and DA OR Employee Share with interest OR Cost Whichever is least 1 One 1ONE Member Declaration Form from Member II Para 68BB.

The conditions for the withdrawal are as follows. We will look into partial PF withdrawal rules on education health and marriage. This will open a new section of the form asking you to select the Purpose for which withdrawal advance is required.

Provident Fund Withdrawal via Old Form. If you meet this condition you can follow the procedure given below to withdraw your EPF online. The EPF outstanding balance basically means employees share employers share and EPF interest.

It is possible to withdraw either 50 or all of the amount contributed and all accrued interest. Also you can withdraw your EPF money for any other professional course. This form is to be submitted by employees who fall under the age bracket of 50 years ie aged below 50 years.

You can also withdraw your EPF amount for educational purposes. One can withdraw the advance amount from their PF. Step 2- From the top menu bar click on the Online Services tab and select Claim Form-31 1910C 10D from the drop-down menu.

This advantage can be availed only for post matriculation educational expenditures. 5 crore workers registered under Employee Provident Fund or EPF to get non-refundable advance of 75 of the amount or three months of the wages whichever is lower from their accounts. Sign the Certificate of Undertaking by clicking on Yes and proceed with the steps.

One can withdraw 6 months basic wage and dearness allowance or the employee share along with interest whichever is less. You have to first contact the HR team of the previous employer to get the Form 19 for EPF withdrawal.

Epf Withdrawal Education Finance Tips How To Apply

Check Your Epf Balance Now At Financial Fitness Online Loans Credit Worthiness

File An Rti Application For Epf Withdrawal Or Epf Transfer Stutus Application Letters Lettering Money Buys Happiness

Epfo Portal Filing Taxes Private Limited Company Online Registration

Submit Form 15g For Epf Withdrawal Online Tds Sample Filled Form 15g Fillable Forms Tax Forms Income

Tax On Epf Withdrawal Rule Flow Chart Personal Finance Rules

Some Facts About Epf That Impact Your Retirement Savings Saving For Retirement Facts Money Today

Epf Withdrawals New Rules Provisions Related To Tds Tds Is Applicable W E F 1st June Budgeting Tax Deducted At Source Gucci Mane Kids

Provident Fund Epf Withdrawal Transfer How To Do It Online Financial Education Financial Transfer

Pf How To Withdraw Pf Online Without Employer Signature Employment Signature Withdrawn

Epf Partial Withdrawal Or Advance Process Form How Much

How To Apply For Epf Withdrawal From Account 2 For Education Eduspiral Consultant Services Best Advise Information On Courses At Malaysia S Top Private Universities And Colleges

Covid 19 Know How Much You Can Withdraw From Your Epf

Epf Withdrawal Rules How To Become Successful Rules How To Become

Pf Withdrawal How To Withdraw Pf Amount Online Legal Services Withdrawn Tax Deducted At Source

Epf Withdrawal Made Simple No Sign Required From Employer Make It Simple Employment How To Plan

How To Withdraw Epf And Eps Online Basunivesh

Check Epf Balance In 4 Easy Steps Online Infographic Balance Sms

Epf Withdrawal Rules When And For What You May Withdraw Your Epf